A web page from Kubient’s July 2020 prospectus for its preliminary public providing (IPO), making just a few daring claims in regards to the agency’s expertise that will later issue into federal prosecutors’ fees.

Credit score:

SEC

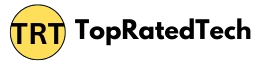

Earlier than Kubient’s IPO in August 2020, Kubient issued a prospectus noting analysis figures that instructed $42 billion misplaced to advert fraud in 2019. Kubient’s expertise was touted as quick sufficient to work within the 300-millisecond real-time advert public sale window. It leveraged “machine studying powered [sic] pre-bid advert fraud prevention expertise” and a “self-learning neural community at all times getting smarter.”

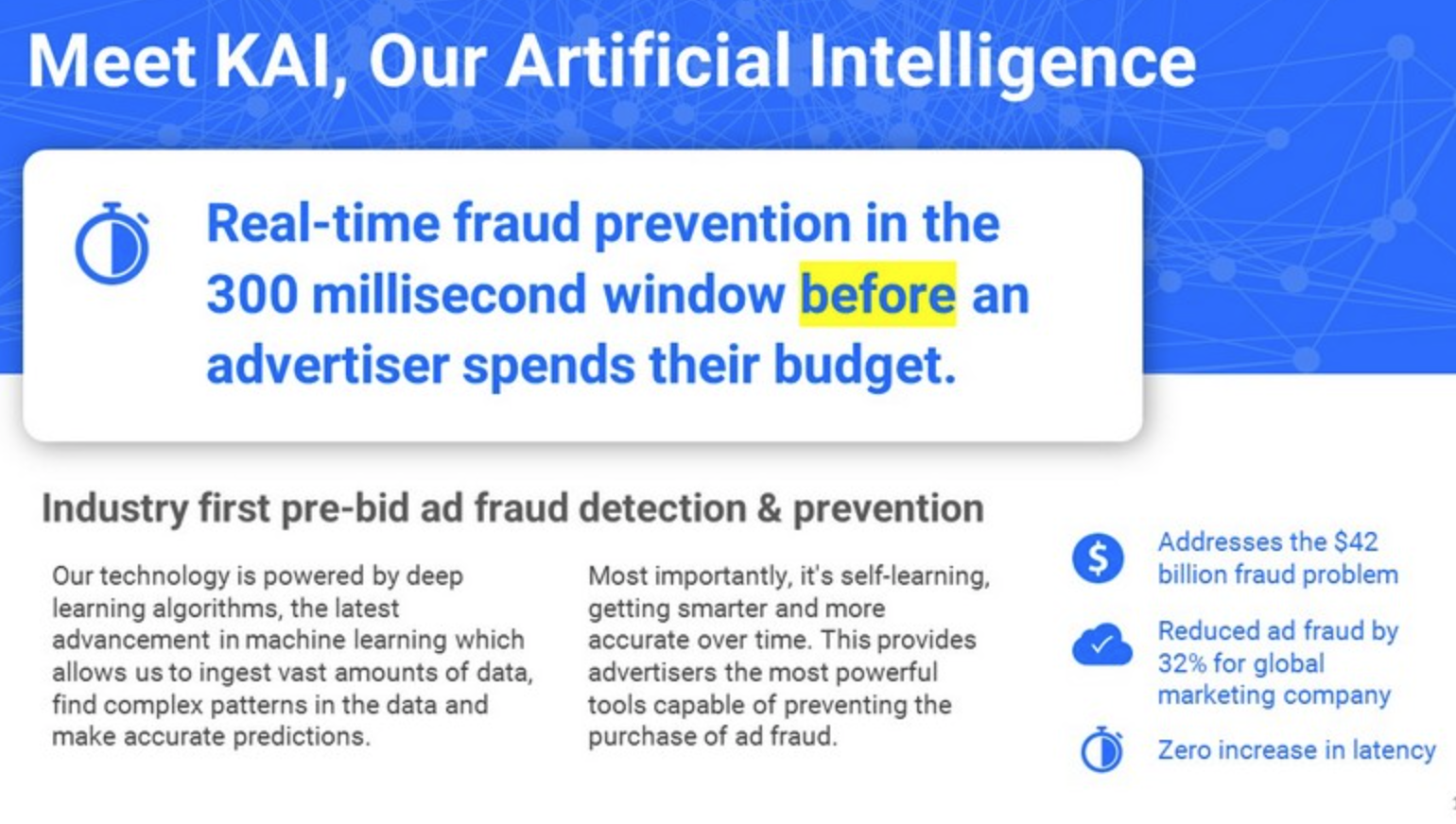

Revenues for the primary quarter of 2020 have been proven as $1.38 million, an enormous leap from $177,635 in Q1 2019, because of “two enterprise clients” that “efficiently beta examined KAI.” Prosecutors noted at the time of Roberts’ plea that he personally added language that Kubient was “figuring out and stopping roughly 300% extra digital advert fraud” than a consumer’s present advert companions. Kubient raised greater than $33 million throughout its preliminary and secondary fairness choices.

Investigations by the Securities and Trade Fee, US Postal Inspection Service, and the US Lawyer’s Workplace for the Southern District of New York led to fees in opposition to Roberts in September 2024. Joshua A. Weiss, Kubient’s former chief monetary officer, and Grainne M. Coen, a former audit committee chair, have been additionally charged on the time.

Roberts, 48, confronted as much as 20 years in jail on a single cost of securities fraud. He will probably be topic to at least one yr of post-release supervision after serving his time period.

Kubient, which was reported to be in Chapter 7 liquidation proceedings on the time of Roberts’ plea, was announced as merging with Adomni and taking up the Adomni title in Could 2023.