Why you may belief TechRadar

We spend hours testing each services or products we evaluation, so that you could be certain you’re shopping for the most effective. Find out more about how we test.

PayPal is hottest for on-line funds processor and arguably pioneered the Twenty first-century on-line payment processing market. It started with a easy digital funds system within the Nineties and has since expanded into many different providers, together with a point of sale (POS) system.

In 2012, PayPal launched a POS resolution known as PayPal Right here. Then, in 2018, it acquired a Swedish firm, iZettle, that supplied a POS resolution, amongst different providers. In 2021, PayPal Right here was retired and changed by the PayPal Zettle POS. This service lets companies settle for in-person funds and preserve in depth monetary data.

I examined PayPal Zettle that can assist you resolve if it’s a really perfect resolution for your enterprise. My evaluation focused on its core options, pricing, and user-friendliness. Learn on to be taught what PayPal provides with its point-of-sale system.

Zettle POS: Plans and pricing

PayPal fees a regular 2.29% plus 9 cents for card-present transactions. If card particulars are manually keyed in, the charges rise to three.49% plus 9 cents (POS suppliers cost extra for handbook transactions to cowl elevated dangers). These charges are on par with most POS suppliers I’ve examined; 2% to 2.5% plus 5 to fifteen cents is the norm.

You don’t want recurring month-to-month or annual charges to entry PayPal’s point-of-sale software program, setting it aside from rivals with vital month-to-month or yearly charges.

I’ve reviewed a handful of POS techniques that require $50 to $200 in month-to-month charges to entry their options; this value provides up for companies with restricted budgets, however PayPal doesn’t have this problem.

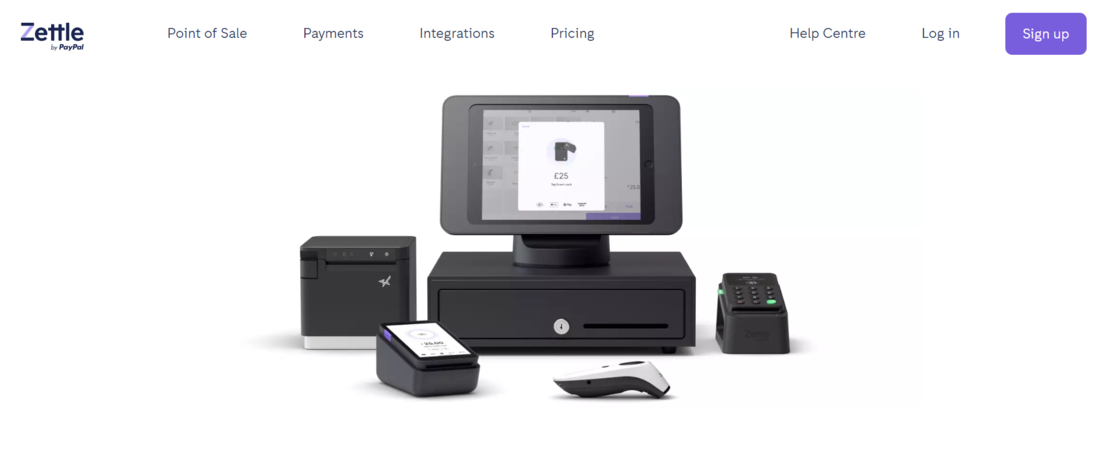

PayPal provides two {hardware} choices: a conveyable card reader and an all-in-one Terminal. You should purchase your first card reader at a reduced $29. Subsequent card readers will value the usual $79. This card reader will likely be paired with the PayPal Zettle app to simply accept funds.

In distinction, you don’t must pair the Terminal with an exterior smartphone. It’s a standalone machine that runs the PayPal Zettle app immediately. The usual Terminal prices $199, and the one with a built-in barcode reader prices $239.

PayPal’s {hardware} techniques are moderately priced. They value a lot lower than related {hardware} from some POS distributors I’ve reviewed. I like that PayPal has affordable transaction charges and no recurring charges, making it an economical possibility.

Zettle POS: Options

PayPal supplies a system for companies to simply accept in-person funds. It lets your prospects scan, swipe, or faucet their playing cards to pay for items and providers. Clients may also pay you through contactless cost apps like Apple Pay and Samsung Pay. Alternatively, you may manually sort in a buyer’s card particulars, however such transactions have significantly greater charges.

At 2.29% plus 9 cents per transaction, PayPal’s charge isn’t too excessive in comparison with the competitors, however it isn’t low both. It sits on the center of the POS techniques I’ve reviewed. Charges are essential for any enterprise selecting a POS system, and handing over 2.3% of each transaction can really feel burdensome. Nevertheless, most POS techniques with related options cost inside this vary.

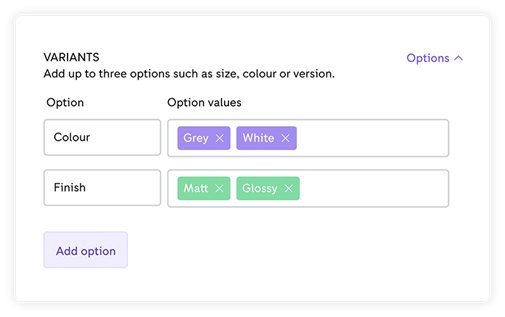

I like that PayPal provides an built-in system for accepting funds, managing stock, and collating buyer knowledge. The PayPal Zettle app permits you to create an intensive product catalog, and product particulars could be shortly retrieved when a buyer desires to pay.

Suppose you run a small clothes retailer. You possibly can add all of your retailer’s clothes objects to your PayPal catalog, together with particulars like their value, dimension, colours, and so on. You possibly can specify the amount of every merchandise in your stock. When prospects select a particular merchandise, you may retrieve it from the system, they usually’ll pay the corresponding value.

As soon as an merchandise is purchased, the sale is straight away subtracted out of your stock. Suppose you have got 5 items of an merchandise and prospects purchase two, the stock depend turns into three. You possibly can set PayPal to provide you with a warning when a product’s amount falls beneath a particular threshold, guaranteeing you restock the products to keep away from disappointing prospects.

PayPal provides a Terminal with a built-in barcode scanner, which simplifies operations in your retailer. You possibly can create, print, and connect a novel barcode to each product in your retailer. When somebody picks an merchandise, you may shortly scan it to retrieve the main points.

I like that PayPal provides a built-in barcode scanner, saving customers the expense of shopping for exterior barcode {hardware}. The built-in barcode scanner labored reliably throughout my check; it scanned merchandise and retrieved particulars with out problem.

Nevertheless, you should utilize an exterior barcode scanner if that’s your choice; many companies choose this for redundancy. PayPal’s point-of-sale system could be built-in with exterior barcode apps.

The identical goes for exterior peripherals like receipt printers and money drawers. You possibly can combine PayPal Zettle’s software program with exterior {hardware} equipment, a plus for companies that wish to create a customized setup.

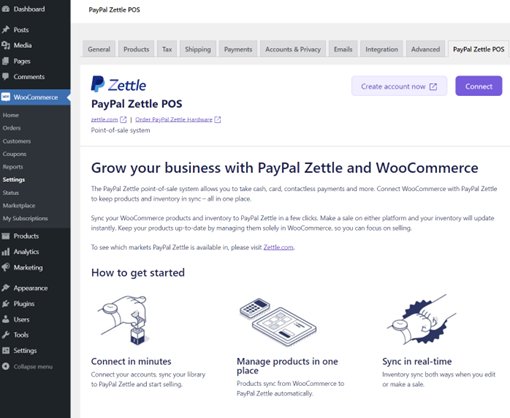

PayPal’s POS system helps direct integration with some third-party instruments. For instance, you may join your system to QuickBooks, a well-liked accounting app. With this integration, gross sales in your POS system are routinely added to your accounting data.

This method integrates with common e-commerce instruments like Shopify, BigCommerce, and WooCommerce. Therefore, you may sync your in-person gross sales catalog together with your on-line retailer.

Nevertheless, I didn’t like that PayPal has restricted direct integrations. I discovered just a few dozen instruments in its native integration library, in contrast to some POS techniques that immediately combine with a whole bunch of instruments.

If you might want to combine your PayPal POS system with an present instrument, you would possibly want a developer to deal with it, as PayPal provides direct integration just for just a few dozen apps. On the brilliant facet, PayPal supplies straightforward API entry and detailed documentation for builders to combine exterior instruments.

Although I didn’t expertise it, a noticeable criticism arose when researching third-party opinions about PayPal Zettle. Some customers complained about their accounts being paused for safety functions, with PayPal asking for extra data to confirm their enterprise. Help is usually restricted throughout this course of, and customers get confused about which paperwork to add. Accounts below evaluation can’t settle for funds within the meantime, inflicting losses.

PayPal undoubtedly doesn’t block accounts for enjoyable. Nevertheless, the corporate has an notorious automated evaluation system that may ensnare respectable customers, and coping with PayPal’s assist group could be irritating when this occurs.

Zettle POS: Interface and use

PayPal Zettle has a minimalist, trendy interface that I loved utilizing. It’s one of many best-designed POS techniques I’ve examined, and that’s numerous techniques. It sports activities a white background and light-weight colours to spotlight options. The principle options are neatly positioned on the left facet, and the dashboard is on the best.

I didn’t face any complications organising the point-of-sale system. For those who’re utilizing a card reader, you’ll should obtain the cellular app (iOS or Android) and pair it with the reader. Pairing works easily through Bluetooth.

For those who’re utilizing the Terminal, the setup turns into simpler since you don’t must pair with an exterior machine. You possibly can observe the on-screen directions to arrange the Terminal.

In fact, you may nonetheless obtain the cellular app for straightforward monitoring. For example, when you’ve got a number of POS gadgets throughout completely different shops, you may monitor your gross sales on every one out of your central PayPal dashboard. Your knowledge will likely be organized in a shortly digestible format, so that you don’t must stress about extracting insights.

Zettle POS: The competitors

PayPal Zettle has an limitless checklist of rivals, however I’d like to spotlight Clover as the principle rival. It provides strong options and is designed particularly for small companies.

Clover fees 2.6% plus 10 cents for card-present transactions and three.5% plus 10 cents for manually keyed-in transactions. Its transaction charges are greater than PayPal’s. Clover additionally fees month-to-month charges starting from $15 to $90, in contrast to PayPal, which has no recurring charges.

Nevertheless, Clover is a extra versatile instrument with a broader assortment of third-party integrations. It may be used for several types of companies, together with eating places.

Clover supplies extra complementary options than PayPal, corresponding to worker time administration. It’s extra versatile than PayPal Zettle, however the tradeoff is greater charges.

Zettle POS: Last Verdict

PayPal Zettle is a good point-of-sale resolution for small companies looking for a easy setup. It provides aggressive transaction charges, a well-designed interface, and inexpensive {hardware} choices.

But, I don’t rank PayPal Zettle as a really perfect POS resolution for big companies. It doesn’t provide many superior options and has restricted third-party integration. Its charges are aggressive, however it’s not the versatile resolution that giant retailers want.