Why you possibly can belief TechRadar

We spend hours testing each services or products we evaluation, so that you may be certain you’re shopping for one of the best. Find out more about how we test.

Our collection on identity theft protection apps will consider the options, pricing choices, competitors, and likewise the general worth of utilizing every app. Nonetheless, these usually are not full hands-on critiques since evaluating id theft safety apps is sort of inconceivable. It will require a number of months of testing, purposefully hacking accounts to see if the safety app works, handing over personally identifiable data, performing a number of credit score checks, and risking publicity of the reviewer’s personally identifiable data.

There may be lastly an id theft prevention program that’s price your money and time among the many multitude of choices out there. That is significantly noteworthy since MyFico is the buyer arm of the corporate that created the FICO credit score rating, which has been an business customary for greater than 25 years.

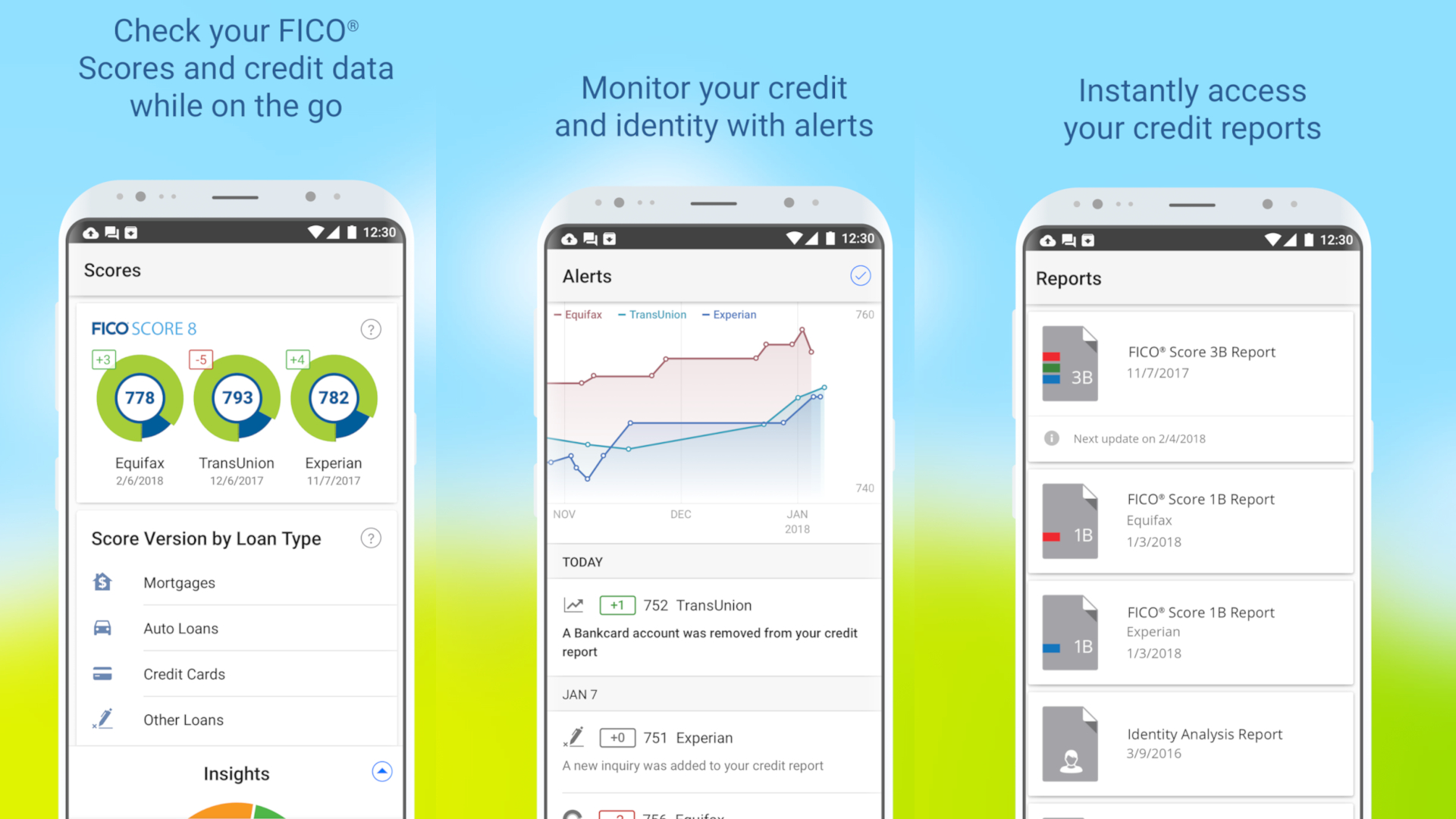

MyFico locations a robust emphasis in your credit score rating and credit score reporting, providing a variety of instructional content material in addition to detailed details about your credit score state of affairs. The cellular app presents this data in a vibrant and easy-to-understand method, boasting a extra polished look than a lot of the functions we have tried. Though this product is usually priced larger than others, it meets all the standards for a high-quality providing.

At first, the consumer interface (UI) is easy and simple to navigate. That is essential as a result of a careless and unappealing UI could make any program tough to make use of. Rapidly discovering the options you want may also help you defend your self towards criminals or hackers trying to steal your personally identifiable data, which makes id theft safety important. MyFico’s colourful show of credit score scores contains pop-up alerts that notify you of potential dangers.

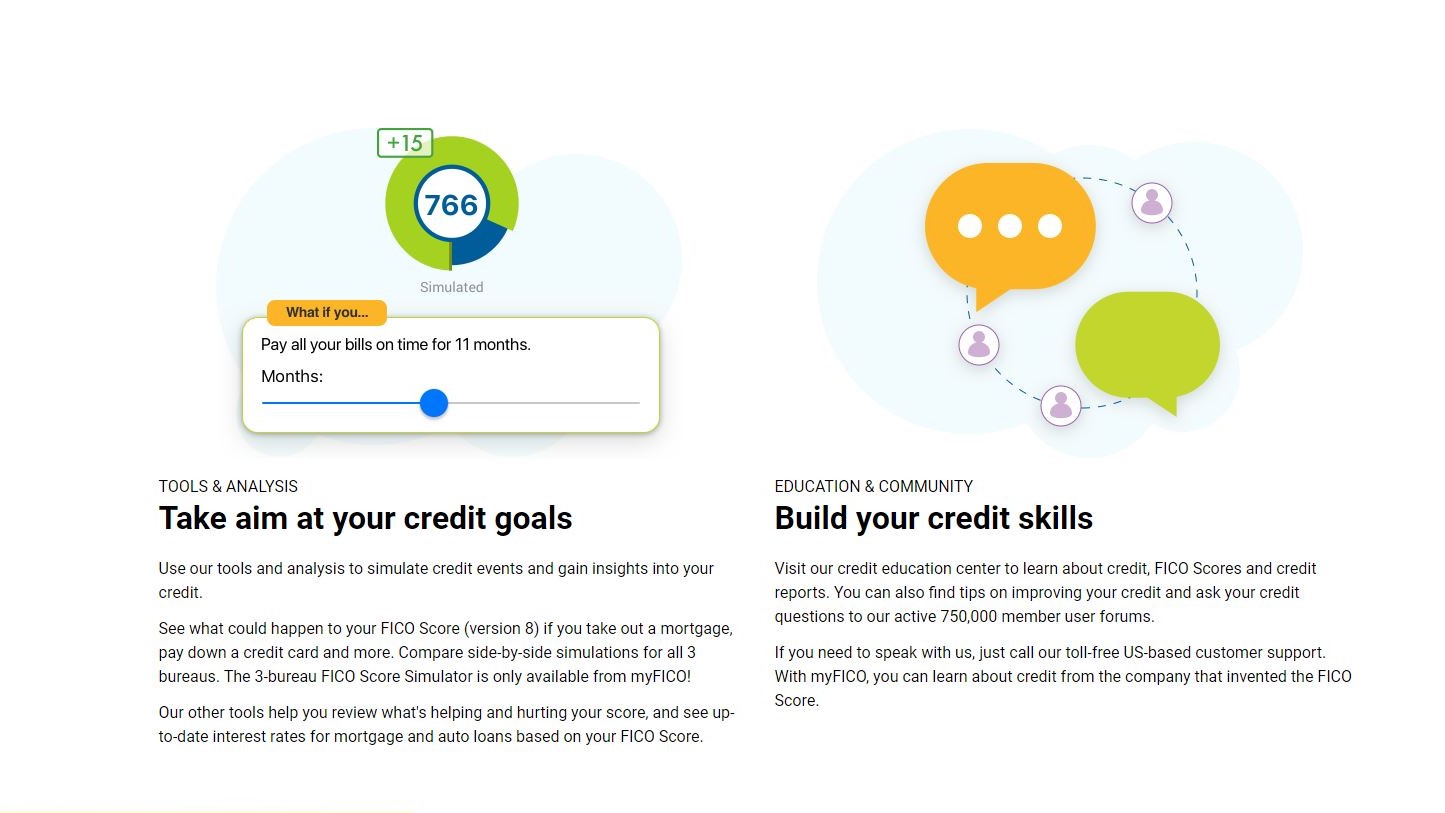

Like many different merchandise, the app affords $1 million in id theft safety, though a number of the extra primary opponents present comparable protection. Moreover, a credit score rating simulator is on the market, permitting you to see how varied actions, resembling taking out a brand new auto mortgage, might have an effect on your credit score rating. The group behind MyFico is well-known and respected. Total, that is an efficient and clever product for monitoring your on-line presence.

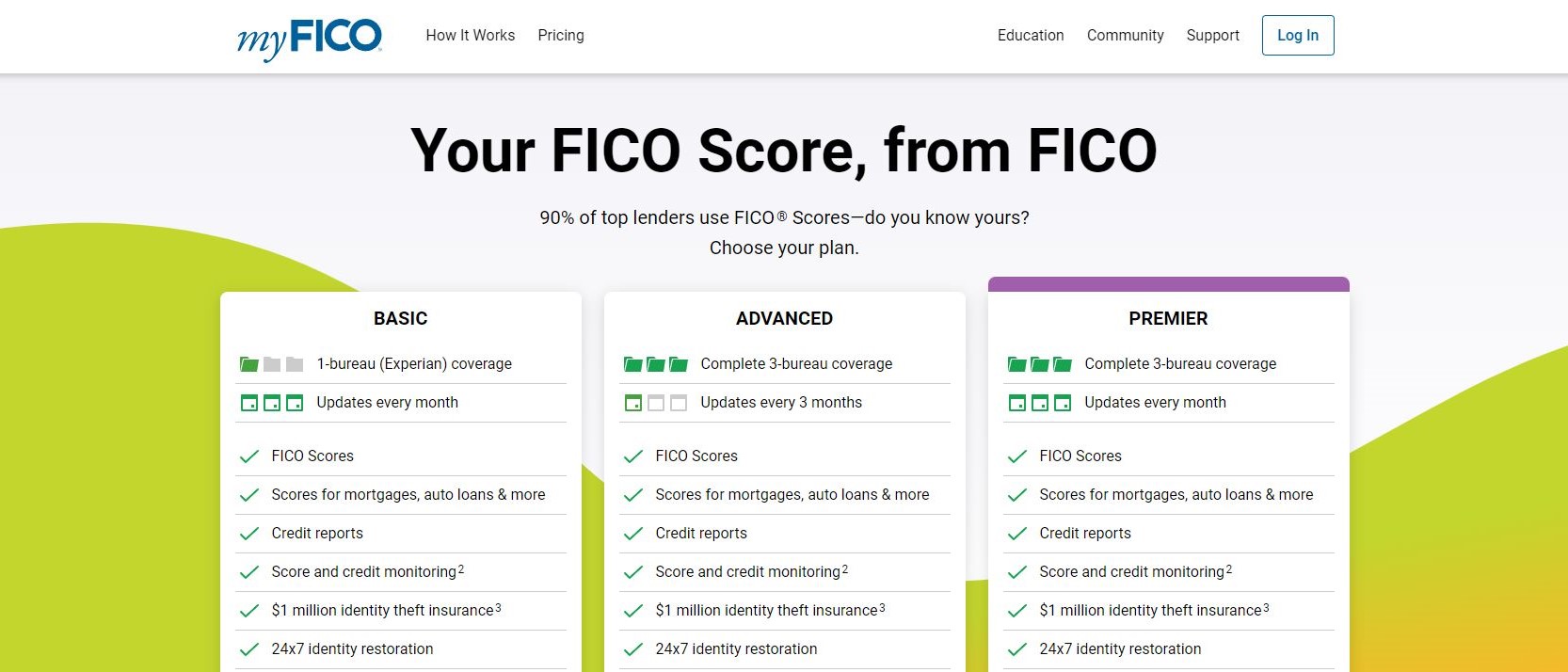

MyFico: Plans and pricing

MyFICO affords a spread of plans to assist customers monitor their credit score and id, with pricing structured throughout totally different tiers. The Free Plan offers primary protection, together with a FICO Rating 8 primarily based on Equifax knowledge, month-to-month Equifax credit score stories, and 24/7 credit score monitoring.

For extra complete protection, MyFICO has three paid subscription tiers that mechanically renew every month:

Superior Plan: Priced at $29.95 per 30 days, this plan affords three-bureau protection (Experian, TransUnion, and Equifax) with credit score stories and FICO Rating updates each three months. It contains complete credit score monitoring, FICO Rating monitoring with alerts, and id monitoring. Moreover, it offers $1 million in id theft insurance coverage and 24/7 id restoration. Options just like the FICO Rating Simulator and “How Lenders View You” evaluation are additionally included.

Premier Plan: This top-tier plan prices $39.95 per 30 days and affords essentially the most frequent updates, offering three-bureau credit score stories and FICO Scores (together with variations for mortgages, auto loans, and bank cards) on a month-to-month foundation. Much like the Superior Plan, it contains proactive credit score report monitoring and alerts, id monitoring, as much as $1 million in id theft insurance coverage, and 24/7 id restoration. All paid plans characteristic FICO Rating 8 and should embody further variations of the FICO Rating.

Please remember the fact that all subscriptions mechanically renew and are non-refundable

MyFico: Interface

MyFico really stands out within the realm of id theft prevention software program, particularly when in comparison with many different applications that usually resemble outdated tax software program from a decade in the past. One among its most notable options is its vibrant, user-friendly credit score rating indicator, mixed with a smooth, trendy design that makes the cellular app significantly interesting to customers.

The app boasts an intuitive format, permitting customers to simply navigate and entry key options. Checking your credit score rating is a swift and simple course of, whereas delving into potential credit score points or assessing id theft notifications is simply as seamless. This accessibility is significant in a panorama the place well timed intervention could make a major distinction.

One of many app’s standout parts is its credit score rating simulator. Not like conventional calculators that supply restricted insights, MyFico’s simulator operates extra like an interactive wizard. It permits customers to discover varied monetary situations—like buying a house or a automotive—illustrating how these choices would possibly have an effect on their credit score rating. This foresight equips customers with the data they should make knowledgeable monetary selections, making certain they’ll assess whether or not it’s smart to maneuver ahead with vital purchases.

Whereas MyFico comes with the next price ticket than a few of its opponents, the simplicity and effectiveness of its interface may be nicely well worth the funding. If this user-friendly design helps you sort out potential id theft points or forestall future credit score issues, the associated fee turns into a minor consideration in comparison with the peace of thoughts it affords.

In distinction, different id theft safety apps, though they could provide spectacular options, typically fall quick in usability. Their cumbersome and outdated interfaces could make it difficult for customers to find and make the most of these instruments successfully. MyFico’s smooth design and strong performance set it aside, making it a superior alternative for anybody severe about safeguarding their id and sustaining their credit score well being.

MyFico: Options

MyFICO affords a complete suite of options designed to empower you with data and safety over your credit score and id. With MyFICO, you obtain FICO Scores and credit score stories from all three main credit score bureaus: Experian, TransUnion, and Equifax. That is important as a result of 90% of high lenders depend on FICO Scores. By reviewing your stories from all three bureaus, you possibly can establish discrepancies and errors that could be negatively impacting your scores.

Moreover, MyFICO offers credit score monitoring and alerts, constantly monitoring vital adjustments resembling new accounts or inquiries. This lets you shortly detect potential id theft or fraudulent exercise and take instant motion if obligatory. Additionally, you will profit from FICO Rating monitoring and a historical past graph, which visually shows your rating’s development over time, serving to you perceive how your monetary choices affect it.

One significantly useful instrument is the FICO Rating Simulator, which allows you to discover “what if” situations, resembling how paying down debt or making use of for a brand new mortgage might have an effect on your rating. This characteristic empowers you to make knowledgeable monetary selections earlier than taking motion.

Past credit score monitoring, MyFICO affords id monitoring by scanning the darkish internet and public data to your private data. In case your data is compromised, you’ll obtain alerts. Within the unlucky occasion of id theft, you’re protected by id restoration companies and as much as $1 million in id theft insurance coverage. This protection contains 24/7 entry to specialists who can help you in restoration and supply monetary safety for associated bills.

Lastly, MyFICO offers worthwhile credit score training and buyer assist that can assist you perceive the complexities of credit score and provide help at any time when wanted. Collectively, these options offer you a whole image of your monetary well being, proactive safety, and the instruments to confidently handle your credit score and id.

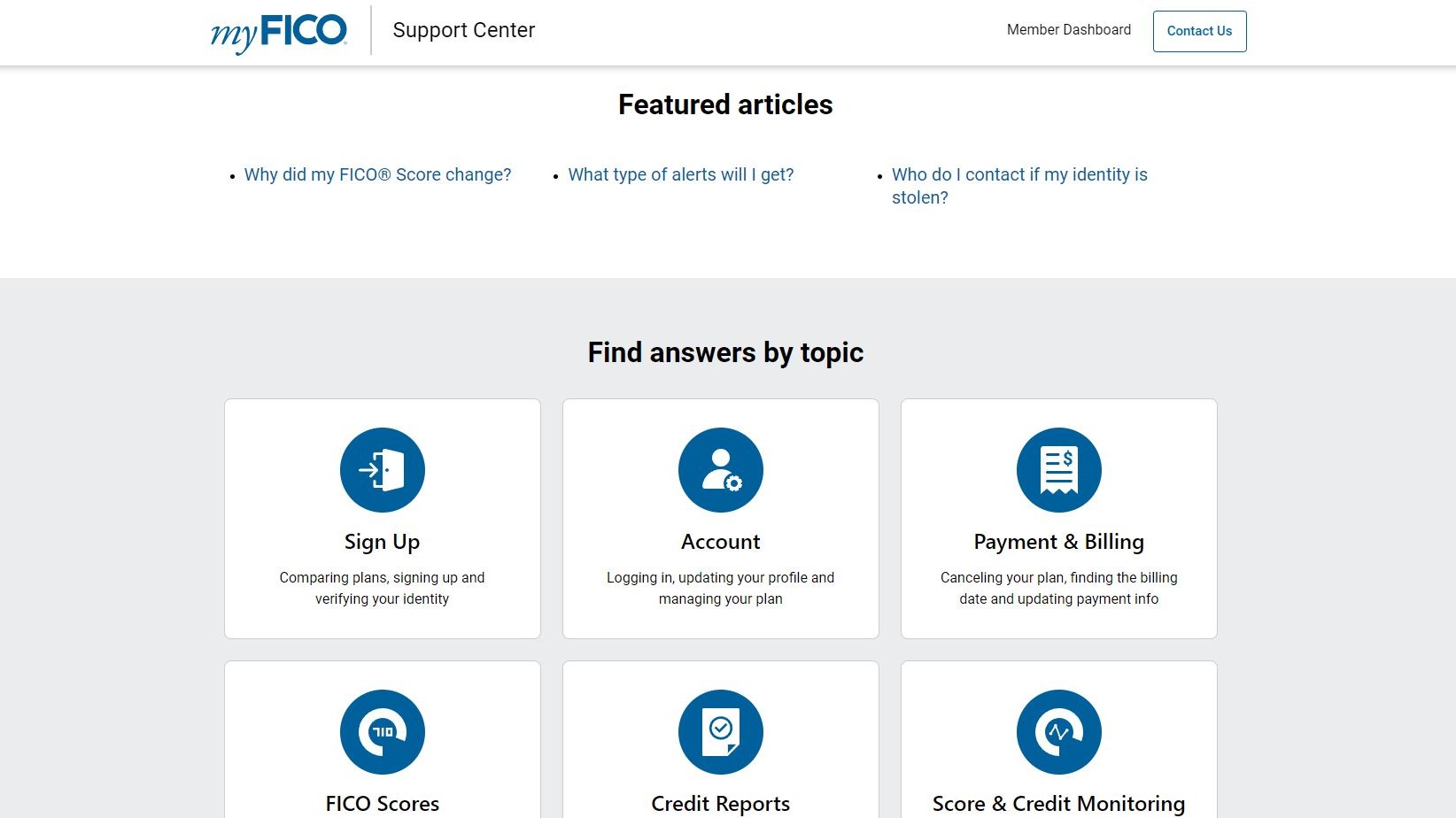

MyFico: Assist

Customers who’re going through issues can get help from the MyFico assist staff. A direct toll-free quantity is supplied, together with what seems to be an e mail tackle however, upon choosing it, directs the consumer to a assist portal. The enterprise is open Monday by means of Friday from 6 AM to six PM and on Saturday from 7 AM to 4 PM PST. There aren’t any selections for faxing or chat.

Moreover, there are articles categorized by topics resembling “Why did my FICO Rating change?” {and professional} credit score training. A dialogue board, ebooks, or video content material usually are not present choices.

MyFico: The competitors

Whereas MyFICO is the official shopper division of FICO and affords direct entry to the extensively used FICO Scores, a number of sturdy opponents present complete credit score monitoring companies, typically with totally different focuses.

Probably the most outstanding opponents is Credit score Karma, which stands out for providing free credit score monitoring companies. Not like MyFICO, which primarily offers FICO Scores, Credit score Karma makes use of the VantageScore® mannequin (generated from TransUnion and Equifax knowledge). Credit score Karma additionally contains options like credit-building instruments, monetary administration sources, and personalised affords for bank cards and loans, making it a preferred alternative for these searching for free and expansive credit score oversight, although it is price noting they share consumer knowledge for advertising and marketing functions.

One other vital participant is Experian, one of many three main credit score bureaus. Experian affords its personal free credit score monitoring service, offering entry to your Experian credit score report and FICO® Rating. Additionally they have a novel characteristic referred to as Experian Enhance, which permits customers to probably enhance their FICO Rating by together with on-time funds for utilities, telephone payments, and streaming companies. Whereas MyFICO additionally affords FICO scores, Experian’s direct connection to one of many bureaus and its Enhance characteristic provide a definite benefit for some customers.

Past these, different companies like CreditWise by Capital One (free, providing TransUnion VantageScore and credit score report monitoring), SmartCredit (providing three-bureau stories and scores with credit-building instruments), Aura, Identification Guard, and LifeLock present varied ranges of credit score monitoring and id theft safety. These typically bundle credit score monitoring with extra strong id theft insurance coverage, fraud alerts, and even digital safety features, catering to customers who prioritize complete safety past simply credit score rating monitoring. The important thing distinction typically lies within the particular credit score scoring mannequin used (FICO vs. VantageScore), the variety of credit score bureaus monitored, and the inclusion of further companies like id theft safety or monetary administration instruments.

MyFico: Last verdict

We have now a robust appreciation for the user-friendly interface and the in depth vary of options supplied by the MyFico service. One of many standout benefits of this platform is the reassurance it affords; you will not have to fret about navigating the murky waters of obscure id theft corporations. MyFico is backed by a well-established model recognized for its credibility and trustworthiness, which is a major benefit within the realm of monetary safety.

An efficient place to begin for monitoring your monetary well being is by checking your FICO rating, because it serves as a vital indicator of your creditworthiness. Maintaining a tally of this rating permits you to make knowledgeable choices concerning your credit score historical past and potential discrepancies which will come up.

Moreover, we recognize that even essentially the most primary plan contains id theft insurance coverage, offering peace of thoughts within the unlucky occasion of fraud. This proactive strategy to id theft safety is a substantial profit for people searching for complete safety. Furthermore, in case you ever end up needing help, MyFICO’s buyer assist is on the market across the clock, making certain that assistance is at all times at hand at any time when it’s possible you’ll want it.

Whereas we contemplate the MyFico answer to be strong and dependable, it’s price noting that we consider companies like Norton LifeLock and IdentityForce edge it out, as they ship a wider vary of options at a extra aggressive worth level. These alternate options present enhanced choices that cater to various wants and budgets, making them worthy contenders within the panorama of id safety.

We have additionally highlighted the best identity theft protection