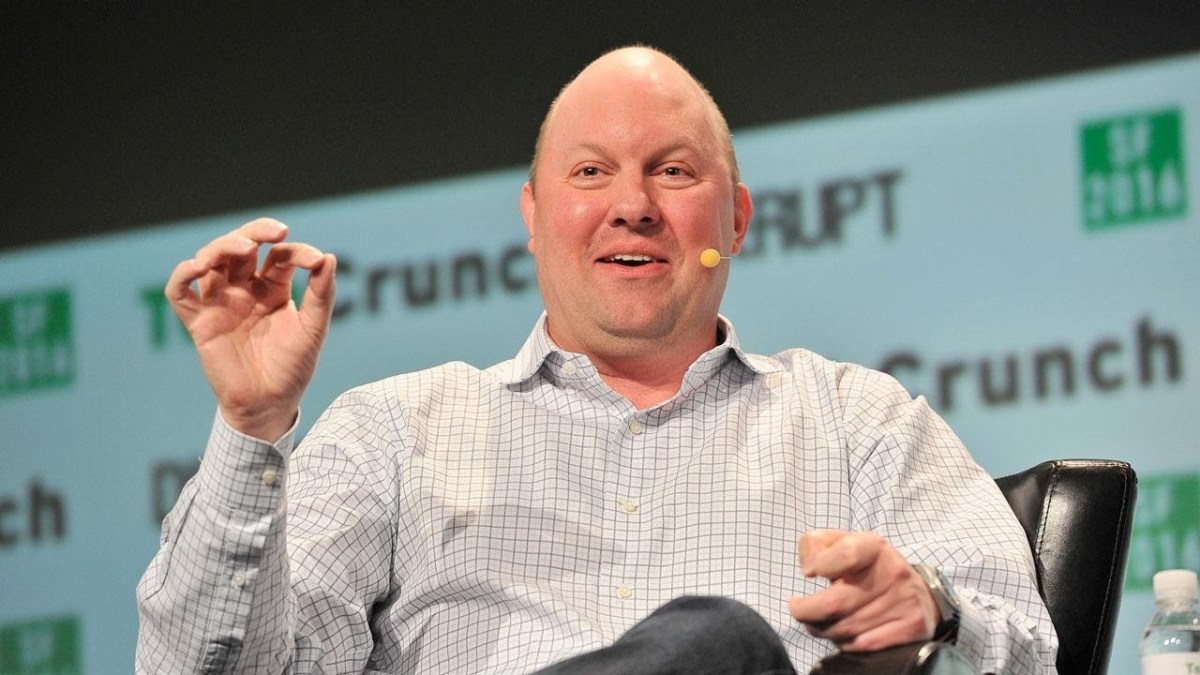

Many enterprise business observers have wondered whether or not Andreessen Horowitz, a agency that manages $45 billion, has its sights on ultimately turning into a publicly traded firm.

Co-founder Marc Andreessen stated he isn’t “chomping on the bit to take the agency public,” on this week’s Invest Like the Best podcast. However he mentioned his aim of constructing a16z into a permanent firm, drawing inspiration from JP Morgan and publicly traded personal fairness companies.

Traditionally, enterprise capital companies have been partnerships consisting of a “small tribe of individuals sitting in a room collectively, making an attempt to bounce concepts off of one another once they make investments,” Andreessen stated on the podcast.

The issue with the partnership mannequin, he stated, is that it’s extremely depending on the concepts and experience of these individuals on the desk with “no underlying asset worth,” as he described it. As soon as the unique companions retire, the agency loses a number of its worth, even when a brand new technology of buyers takes over.

“However even when they’ll hold it going, there’s no underlying asset worth. That subsequent technology is simply going to have at hand it off to the third technology,” he stated. “That’s in all probability going to fail on the third technology. It’s going to be on Wikipedia sometime: that agency existed, after which it went away.”

The partnership mannequin may be profitable. A16z’s billions below administration generates sizable cash administration charges for the agency, along with earnings made when its investments succeed.

Nevertheless, Andreessen stated he consistently reminds inside employees and restricted companions that the corporate isn’t elevating cash simply to reap the charges. It’s to offer the corporate the money to spend money on rising corporations.

“After we go for scale, it’s as a result of we expect it’s essential to help the sorts of corporations we need to assist our founders construct,” he stated.

Andreessen says his greater aim for a16z is to create an organization that lasts. A substitute for a partnership is to construct an funding firm that’s managed like a enterprise, which implies it has administration, a number of layers of employees, division of labor with specializations, and coaching applications, Andreessen stated.

There are definitely precedents of small partnerships evolving into massive companies, which Andreessen can use as a mannequin for a16z’s ambitions.

“Goldman Sachs and JP Morgan, 100 years in the past, regarded like little enterprise capital companies,” he stated. “Then their leaders, over time, turned them into large franchises and massive public corporations.”

He named different examples, too, of personal partnerships was massive publicly traded corporations like large personal fairness companies. Blackstone, which now has a market capitalization of over $200 billion, went public in 2007. Apollo, KKR, and Carlyle held their IPOs quickly after Blackstone, and TPG listed on Nasdaq in early 2022.

Andreessen argues that as these corporations grew from partnerships into massive companies, their long-term success turned much less depending on a number of key buyers.

“An enormous a part of what we’ve been making an attempt to do is construct one thing that has that sort of enduring side to it,” he stated.

In some ways, Andreessen Horowitz already appears to be like extra like an working firm than many VC companies. A16z has dozens of individuals in its advertising group and huge groups that assist portfolio corporations recruit expertise and promote their merchandise. The agency runs separate crypto, bio and well being, and American dynamism methods.

However perhaps there’s another excuse Andreessen is eager to restructure away from the basic VC system. On the subject of partnerships, he says, “It really seems normally, what you uncover is that folks really don’t like one another that a lot.”